China: ‘Internationalisation of Renminbi is planned in three phases’

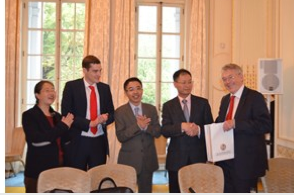

In October the first roadshow for the internationalisation of the Renminbi started during a OMFIF-seminar. I attended this meeting as well and would like to share the minutes, as published by OMFIF, on this important seminar;

In October the first roadshow for the internationalisation of the Renminbi started during a OMFIF-seminar. I attended this meeting as well and would like to share the minutes, as published by OMFIF, on this important seminar;

- ‘As Chinese trade and investment grow, so does demand for the renminbi. China is seeking to ‘normalise’ its currency, working towards convertibility, increased use in global trade invoicing and settlement, and eventually international reserve currency status.

- The internationalisation of the currency is planned in three phases, said Tu Yonghong, director of the International Monetary Institute at Renmin University. First, it will be used for international trade through China’s onshore hubs; then it will be used across Asia; and finally it will become a global currency.

- Standard Chartered, which monitors seven offshore centres including Singapore and Hong Kong, estimates that global use of renminbi has already increased 20-fold since 2010.Shift away from the dollar

- The People’s Bank of China is handling the expansion with care, with no overt plans to oust the dollar as ‘top dog’. ‘China is in a strange position as a developing country and a major creditor nation,’ said David Marsh, managing director of OMFIF. ‘It has fallen into the trap of becoming America’s banker, and giving money to the world.’

- China is keen to diversify its portfolio away from dollars. When reserves passed $1tn in 2005, Governor Zhou Xiaochuan of the People’s Bank of China said, ‘We have enough’. Nevertheless, holdings have now ballooned to $3.8tn, and China has made negative returns on its dollar holdings. Marsh suggested that China has been ‘too generous to the US’ by holding so much US Treasury debt and must now ‘be generous to the people of China’. One way of safeguarding China’s assets would be to persuade debtors to borrow in renminbi.

- Renmin University – ‘the finishing school for China’s bankers’ – tracks global use of the renminbi through its ‘Renminbi Internationalisation Index’. On a scale from zero (no global use) to 100 (complete global use), renminbi use measured 1.6 this year, and is likely to reach 20%-30%, according to Prof. Liu Zhenya. The dollar accounts for around half of global trade, the euro about a third, and the yen and sterling around 4% each. Zhenya thought it unlikely that Japan’s stake would shrink; Europe and the US were most likely to reduce their share. Though their slices may become slimmer, ‘the cake is growing’, said Jinny Yan of Standard Chartered.Renminbi bonds

- The UK has become the first full-fledged sovereign to issue debt denominated in renminbi. The proceeds of the bonds will be held in the Bank of England’s currency reserves. This will contribute liquidity to the small but growing offshore renminbi market as well as cementing Britain’s position as a western hub for the currency.

- George Osborne, chancellor of the exchequer, sees this development as key to the UK’s economic plans and expects it to boost exports to China, which in turn will help British jobs and investment.

- The use of the proceeds in the Bank of England’s currency reserves makes the renminbi de facto a reserve currency. It is already considered so by African central banks, where it is likely to replace the dollar and euro, said European corporate finance expert Alexander von Mellenthin.International acceptance

- Official reserve status may be approaching. The renminbi could next year become part of the International Monetary Fund’s composite reserve currency, the Special Drawing Right, joining the dollar, euro, yen and sterling, depending on a review to be carried out next year.

- To be accepted, China may need to become more forthcoming with its data. China is ‘not showing all her cards’, said Willem Middelkoop, founder of the Commodity Discovery Fund.

- The PBC does publish detailed statistics in Chinese. It may be a case not so much of reticence but of ‘lost in translation’, said Prof. Ben Shenglin, executive director of the International Monetary Institute.

- When it comes to closer cooperation between China and the IMF, steps need to be taken on both sides. ‘China has a big population, and it needs a big chair in the room,’ said Prof. Zhenya. The governance of the IMF needs to shift to better represent the growing significance of developing economies. ‘Excluding 20% of the world’s population isn’t good for anyone,’ said Zhenya. A non-European managing director would be a good first step – even better if the candidate could command the respect of Capitol Hill, where Congress is stuck on quota reform.Growing demandIndependent of negotiating a larger seat at the IMF, China and its currency are increasing their influence. Market demand is growing. When the London Metal Exchange opened its new clearing house on 22 September, members enquired about posting collateral in renminbi, said Adrian Carr, business development manager at LME. Subject to regulatory approval this will be possible in November, due to popular demand.

- Banks in Paris, Frankfurt and Luxembourg have already lined up to perform clearing for renminbi. As Europe’s financial hubs hurry to become part of the internationalization of China’s currency, there are opportunities to work in partnership rather than in competition. It is likely that each centre will develop a niche: Luxembourg for asset management, London for foreign exchange, Frankfurt for trade and Paris for links to Africa.’

On a personal note I would like to thank Prof. Ben Shenglin of the Renmin University and executive director of the not so well known Chinese International Monetary Institute for his kind invitation to visit his faculty for the presentation of the Chinese edition of The Big Reset in Q2 2015.